Sigmanomics Market Commentary, Week of July 21 – 25, 2025

Summary

The recently released June inflation data revealed a 0.3% month-over-month increase, up from 0.1% in May. This translates to a 2.7% year-over-year increase, fueling the consensus that the Federal Reserve is now unlikely to cut its policy interest rate at its upcoming meeting on July 30. Despite this, equities have remained resilient. The June retail sales data, on the other hand, showed a surprisingly strong improvement of 0.6%, a sharp reversal from May’s 0.9% decline, and further fueling the prevailing bullish sentiment in US equities.

June Inflation Data

Source: Sigmanomics.com

Source: Sigmanomics.com

The US Bureau of Labor Statistics (BLS) released the official June inflation data on Tuesday, July 15. The report showed that inflation accelerated by 0.3% month-over-month in June, up from 0.1% in May, marking the fastest pace in five months. As shown in the chart above, this translates to a 2.7% year-over-year increase, up from 2.4% in May.

This elevated inflation pace fuels the growing consensus that the Federal Reserve, at the very least, is now unlikely to cut its policy interest rate during its next policy meeting on July 30, as doing so risks further aggravating inflation (which is already 0.7% higher than its long-term target of 2%). On the other hand, although still unlikely, the Fed may surprise the market with a minimal policy hike of 25 basis points (0.25%), increasing the interest rate to 4.75%, which will be the highest this year and may then serve as a bearish catalyst in the financial markets.

Retail Sales Growth Data

Source: Sigmanomics.com

Source: Sigmanomics.com

On Thursday, July 17, the US Census Bureau released the official June retail sales growth data. The report showed a faster-than-anticipated month-over-month increase of 0.6%, a surprising reversal from May’s negative 0.9% retail sales decline. Looking into it, the “Sales at Miscellaneous Store Retailers” and the “Motor Vehicles and Parts” saw the biggest gains, with +1.8% and +1.2% growth, respectively.

This significant improvement in retail sales (particularly considering that “Motor Vehicle and Parts” was the second highest driver) came as a surprise, as the general consensus is that we will start seeing the negative effects of the recently announced (and imposed) wide-ranging tariffs in retail consumer spending. Hence, this stronger-than-anticipated retail demand fuels bullish sentiment in the current US economy (at least until we see the eventual slowdown caused by the sweeping tariffs).

Technical Analysis

Source: Sigmanomics.com

Source: Sigmanomics.com

Overview:

Close: 6,296.78 (-0.01%) -0.57

High: 6,313.96

Low: 6,285.27

Nearest Support: 6,150 to 6,200

Nearest Resistance: 6,300 to 6,400

The S&P 500 has extended its bullish rally after breaking above this year’s major resistance and previous all-time high (around 6,100 to 6,150 range). Moreover, we can observe that the prevailing uptrend remains intact and healthy—which is remarkable considering the recent spike in June inflation as reported last Tuesday, July 15. In fact, while the index reacted net negative to the inflation data, it only retraced by 0.40% at the close of Tuesday’s session, demonstrating how resilient the prevailing bullish sentiment is. This also shows the general confidence from the market that, despite the increased inflation, it may not be enough to compel the Federal Reserve to raise its policy interest rate at its upcoming policy rate decision on July 30.

In addition, the recently released June retail sales data last Thursday (July 17) beat market expectations, showing demand from the retail sector remains strong despite the initial expectations of tapered retail sales, mainly due to the recently announced (and imposed) far-reaching tariffs. This then served as the primary catalyst for the index to test the 6,300 level, ultimately closing just marginally below it.

Nevertheless, while the bullish sentiment largely remains intact, we can see that momentum may be weakening, as we can observe the Relative Strength Index (RSI) starts to diverge from the price and trend lower (making lower highs). This RSI divergence can be a hint that the index may be due for a potential correction within this month.

Sigmanomics Best-Case Scenario: Price continues its rally to break above the 6,400-6,500 resistance zone.

Sigmanomics Base Scenario: Price consolidates around the 6,150-6,350 price range in the near term.

Sigmanomics Worst-Case Scenario: Price breaks below its newly established support at the 6,100-6,150 level.

NASDAQ 100 Index (NDX)

Source: Sigmanomics.com

Source: Sigmanomics.com

Overview:

Close: 23,065.47 (-0.07%) -15.57

High: 23,153.21

Low: 23,018.36

Nearest Support: 22,500 to 22,700

Nearest Resistance: 23,400 to 23,600

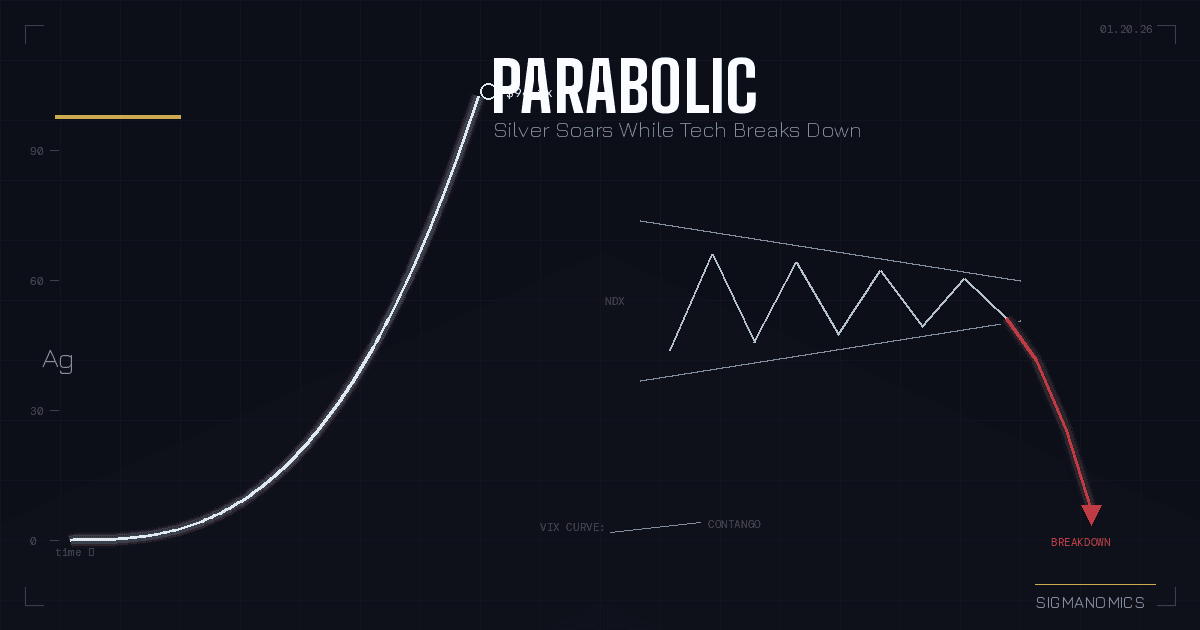

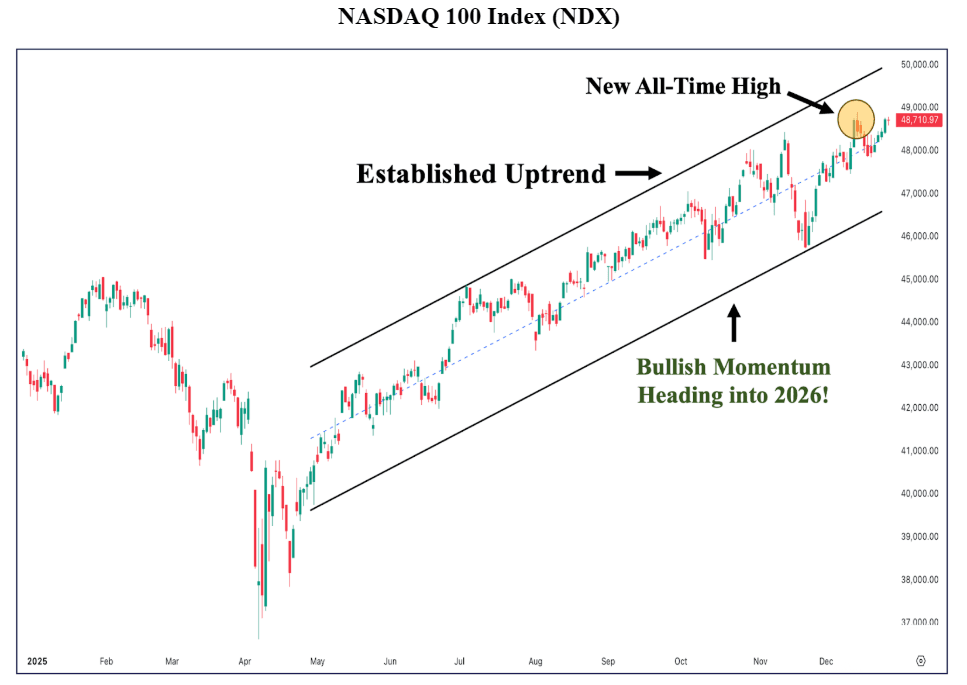

Mirroring the S&P 500, the NASDAQ 100, which tracks the largest technology companies in the US, has also extended its bullish rally as it successfully broke (and closed) above 23,000—a new all-time high price level. In fact, its recent gains are even more substantial than the S&P 500, and even during the recently announced inflation data on Tuesday, the index still managed to close with a 0.13% gain—demonstrating the strength of the prevailing bullish sentiment.

This gain was further extended in the light of the positive retail sales data on Thursday, serving as the main catalyst for the index to break above the 23,000 level for the first time. Nevertheless, we can see that the bullish momentum may be slowing down as we can observe the RSI starts to flatline. This suggests that the index may, at the very least, be due for a consolidation and/or an eventual correction towards the end of the month.

Sigmanomics Best-Case Scenario: Price continues its rally past the 24,000 price level.

Sigmanomics Base Scenario: Price consolidates around the 22,500-23,000 price range in the near term.

Sigmanomics Worst-Case Scenario: Price breaks below its nearest key support level (22,000).

Dow Jones Industrial Average Index (DJI)

Source: Sigmanomics.com

Source: Sigmanomics.com

Overview:

Close: 44,342.19 (-0.32%) 142.30

High: 44,571.68

Low: 44,224.29

Nearest Support: 43,800 to 44,000

Nearest Resistance: 44,800 to 45,000

In contrast to the S&P 500 and NASDAQ 100 indices, the Dow Jones has begun to correct after failing to sustain its bullish rally past its major resistance and all-time high, which was around the 44,800 level. This was consistent with our previous market commentary on July 5, where we observed that the price may struggle to break above the 44,800-45,000 level due to the steep parabolic move it had previously enjoyed, but is, in fact, unsustainable. Hence, a pullback or consolidation was needed if it were to maintain a healthy upward trajectory.

As it stands, the index is unlikely to break its all-time high in the near term, especially given the steep drop (as we can observe above) in the RSI compared to the price. This reflects the faster loss of bullish momentum versus the drop in price, indicating that we can expect the ongoing correction/consolidation to continue in the near term.

Sigmanomics Best-Case Scenario: An unlikely breakout above its 44,800-45,000 major resistance level.

Sigmanomics Base Scenario: Price consolidates around the 43,500–44,500 price range in the near term.

Sigmanomics Worst-Case Scenario: Price breaks below the nearest key support level (43,000).