December 2025 Michigan Consumer Sentiment: A Tentative Rebound Amid Lingering Uncertainty

Table of Contents

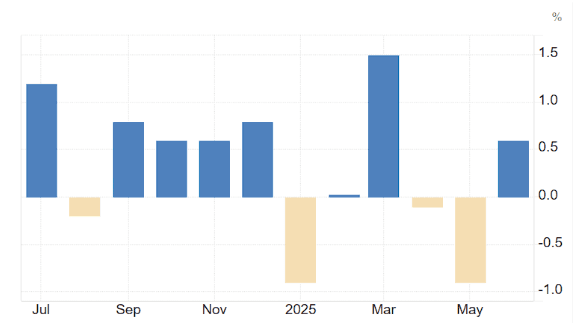

The latest Michigan Consumer Sentiment Index for the US, released December 5, 2025, registered 53.30, up 2.30 points from November’s 51.00 and exceeding the consensus estimate of 52.00. This marks the first increase after five consecutive months of decline, signaling a tentative stabilization in consumer attitudes. However, the index remains significantly below the 12-month average of 56.30, indicating that overall confidence is still subdued compared to the prior year’s readings above 60.

Drivers this month

- Improved labor market conditions with unemployment steady near 3.70%

- Moderation in headline inflation from 4.10% YoY to 3.60% YoY

- Consumer expectations for income growth slightly improved

- Lingering concerns over interest rate hikes and credit costs

Policy pulse

The Federal Reserve’s ongoing restrictive monetary policy, with the federal funds rate at 5.25%, continues to weigh on sentiment. Inflation remains above the Fed’s 2% target, keeping policy tight. The sentiment reading’s improvement suggests consumers may be adjusting to higher rates but remain cautious about future borrowing costs and spending.

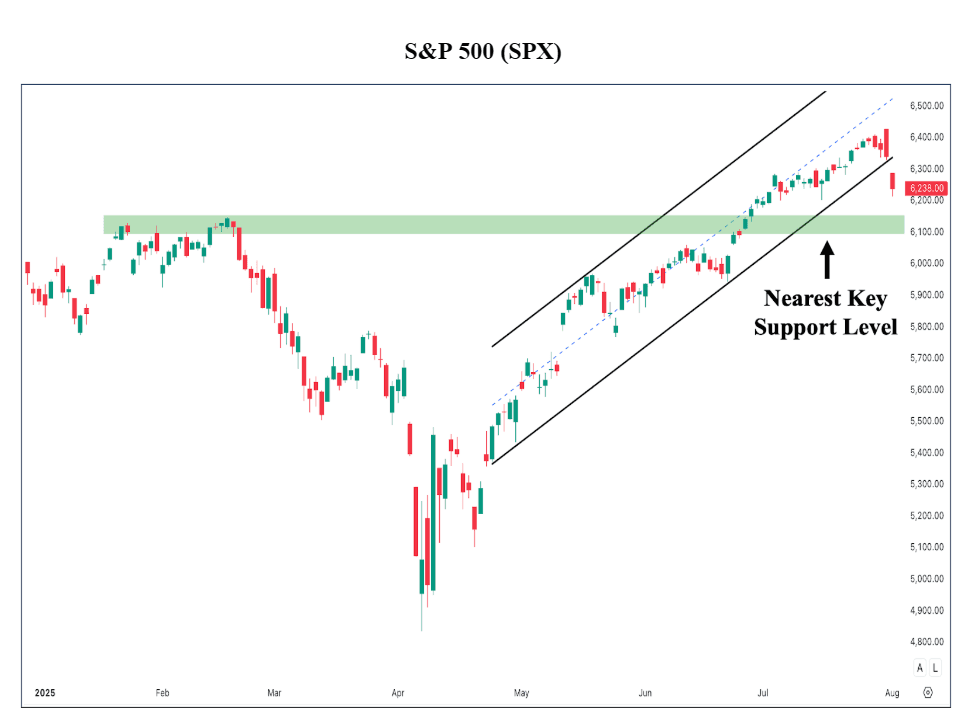

Market lens

Following the release, US Treasury yields on the 2-year note rose 5 basis points, reflecting expectations of sustained Fed tightening. The US dollar index strengthened modestly by 0.30%, while equity markets showed mixed reactions, with consumer discretionary stocks edging higher on hopes of stabilized spending.

Consumer sentiment is a key macroeconomic indicator closely linked to household spending, which accounts for roughly 70% of US GDP. The December reading of 53.30 remains below the 2024 average of 65.40 and the pre-pandemic average near 80, underscoring persistent caution among consumers. This aligns with other foundational indicators:

Inflation and wage growth

Core CPI inflation has eased from a peak of 6.50% in early 2025 to 3.60% YoY in November, while average hourly earnings grew 4.20% YoY. The gap between wage growth and inflation narrows real income gains, limiting discretionary spending power.

Labor market

The unemployment rate remains low at 3.70%, supporting income stability. However, labor force participation has plateaued, and job openings have declined 8% since mid-2025, hinting at a cooling labor market that could dampen future sentiment.

Fiscal policy and government budget

Federal fiscal policy remains moderately expansionary, with a 2025 deficit forecast near 5% of GDP. Recent stimulus measures targeting energy costs and tax relief have provided some relief to households, but long-term budget constraints limit further fiscal support.

Drivers this month

- Energy prices stabilized, reducing cost-of-living pressures

- Improved consumer expectations for business conditions

- Housing market softness continues to weigh on sentiment

Policy pulse

The Fed’s commitment to maintaining restrictive policy is reflected in consumer caution. The sentiment index’s modest rebound may indicate that consumers are beginning to price in a slower pace of rate hikes.

Market lens

Immediate reaction: US 2-year Treasury yields rose 5 basis points, while the US dollar index gained 0.30%. Equity markets showed mixed responses, with consumer discretionary stocks edging up.

This chart highlights a tentative stabilization in consumer sentiment after a prolonged decline. The upward move suggests consumers may be adapting to the new economic environment, but the index remains well below historical norms, signaling cautious spending ahead.

Looking ahead, consumer sentiment faces a complex set of influences. The balance of risks suggests a cautious but not pessimistic outlook for household spending in early 2026.

Bullish scenario (25% probability)

- Inflation falls rapidly below 3%, easing cost pressures

- Fed signals pause or cut in rates by mid-2026

- Labor market remains resilient, boosting incomes

- Consumer sentiment rises above 60 by Q2 2026

Base scenario (50% probability)

- Inflation moderates gradually to 3.50%–4%

- Fed maintains rates near 5% through 2026

- Labor market softens modestly but avoids recession

- Sentiment hovers in the 53–56 range, supporting steady but slow spending growth

Bearish scenario (25% probability)

- Inflation remains sticky above 4%

- Fed tightens further, pushing rates above 5.50%

- Labor market weakens, unemployment rises above 4.50%

- Sentiment falls below 50, risking contraction in consumer spending

The December 2025 Michigan Consumer Sentiment Index signals a cautious rebound after months of decline. While the improvement is encouraging, the index remains subdued relative to historical averages, reflecting ongoing macroeconomic challenges. Inflation dynamics, monetary policy, and geopolitical risks will continue to shape consumer attitudes and spending behavior in 2026. Policymakers and market participants should monitor these trends closely, as consumer sentiment remains a bellwether for the broader economic outlook.

Key Markets Likely to React to Michigan Consumer Sentiment

The Michigan Consumer Sentiment Index is closely watched by markets sensitive to US consumer health. The following assets historically track or react to shifts in this indicator:

- AAPL – Consumer tech demand correlates with sentiment shifts.

- AMZN – Retail sales and e-commerce linked to consumer confidence.

- USDEUR – USD strength often reflects US economic sentiment.

- USDJPY – Risk sentiment and US monetary policy impact this pair.

- BTCUSD – Crypto markets react to risk-on/risk-off shifts tied to consumer outlook.

Insight: Consumer Sentiment vs. AAPL Stock Price Since 2020

Since 2020, the Michigan Consumer Sentiment Index and Apple Inc. (AAPL) stock price have shown a positive correlation, with sentiment dips often preceding short-term pullbacks in AAPL shares. Periods of rising sentiment coincide with strong performance in AAPL, reflecting consumer willingness to spend on discretionary tech products. This relationship underscores the index’s value as a leading indicator for consumer-driven equities.

FAQs

- What is the Michigan Consumer Sentiment Index?

- The Michigan Consumer Sentiment Index measures US consumer confidence based on surveys about personal finances and economic outlook.

- How does consumer sentiment affect the economy?

- Higher consumer sentiment typically leads to increased spending, which drives economic growth, while lower sentiment can signal reduced consumption and slower growth.

- Why is the December 2025 reading important?

- The December reading shows a tentative rebound after months of decline, offering clues about consumer resilience amid inflation and monetary tightening.

Takeaway: The December 2025 Michigan Consumer Sentiment Index’s modest rebound suggests consumers are cautiously adapting to a challenging economic environment, but risks remain elevated for spending and growth in 2026.

This has been drafted with AI assistance and then thoroughly reviewed, refined, and approved by our human editorial team to ensure accuracy, and originality.

The December 2025 Michigan Consumer Sentiment Index rose to 53.30, up from 51.00 in November and below the 12-month average of 56.30. This marks a reversal of the downward trend seen since July 2025, when sentiment peaked at 61.80. The index’s trajectory reflects a slow recovery from the sharp declines triggered by inflation spikes and monetary tightening earlier in the year.

Month-over-month, the 2.30-point increase is the largest gain since March 2025, suggesting some easing of consumer concerns. However, the index remains 14 points below the July peak, highlighting ongoing uncertainty.