Forex August 2025 Analysis and Forecast

Forex Analysis and Forecasts

The foreign exchange market through August 2025 finds itself at its largest crossroads since the immediate post-pandemic era as global growth slows (but not stalls), while headline inflation keeps converging toward targets in most advanced economies. Looking ahead, grabbing headline attention is the ECB’s June staff projections sees the euro-area HICP inflation scalling back to 1.4 percent in the quarter of 2026 before edging back to 2 percent in 2027, while on the other hand, the Federal Reserve’s recent July 2025 meeting left its target fed-funs target unchanged at 4.25 to 4.50 percent. The Fed cited that economic growth “moderated in the first half of the year” and that “uncertainty about the economic outlook remains elevated.”

U.S. Dollar

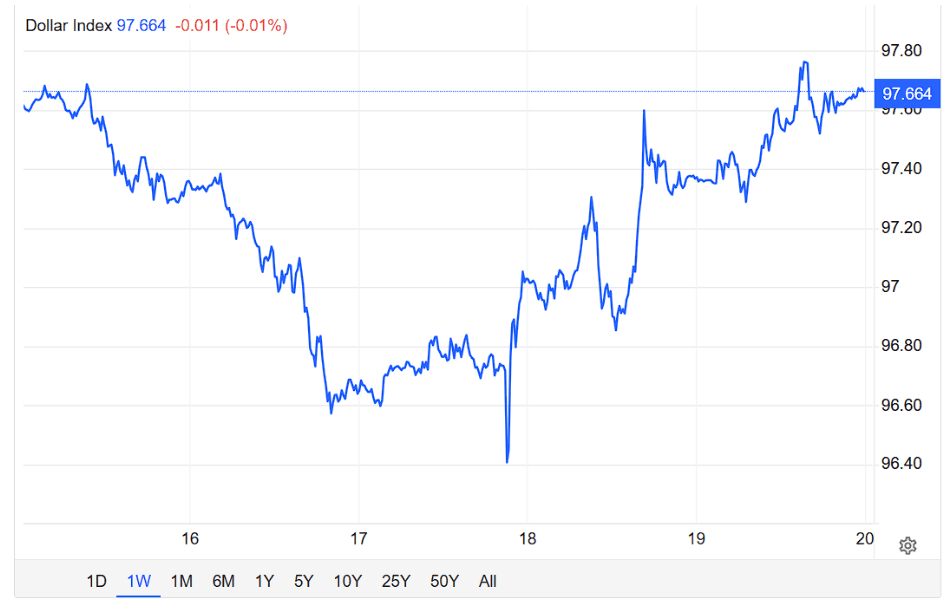

The U.S. dollar, also known as the greenback entered August 2025 looking for lack of better words – drunk! A Reuters poll a the start of July found that “the U.S. dollar will remain weak over the coming months,” with BMO strategist Jennifer Lee saying bluntly, “we are expecting a weaker dollar in the coming months.” To the contrary, CitiPrivate Banka argued in May that “the U.S. Dollar Index may still recover to around 103 in the near term” once the global tariff tanga comes to an end. Not to overlook, Morgan Stanley estimates that foreign investor hedge ratios on U.S. fixed-income holdings now stand at approximately 70 to 100 percent – meaning every uptick in treasury yields spawns fresh demand for short-dated swaps that caps dollar gains.

Source: Sigmanomics.com

Taking a look at the weekly chart of the U.S. dollar index, price action reflects the wobbled greenback that has all but faceplanted, but managed to find its footing at 32.20 trend line support. So long as this floor stays intact, market participants should expect range bound trading, with overhead capped by its psychological resistance at 35.00. With the ‘heard’ expecting the dollar to continue to decline, our analysts here at Sigmanomics note to not overlook chances of a topside breakout which will lead to squeezing out short and medium term bears.